Education, welfare, fire defense, rescue, garbage management, and most of the local services closely related to our daily lives are provided by municipalities and prefectures. Local taxes are a source of funding for such services, borne widely and jointly by the inhabitants of the community and other interested parties, and imposed by prefectures and municipalities according to ordinances.

- TOP

- >Local Tax Bureau(LTB)

As a player in running the system of local taxes

Enhancing local taxes

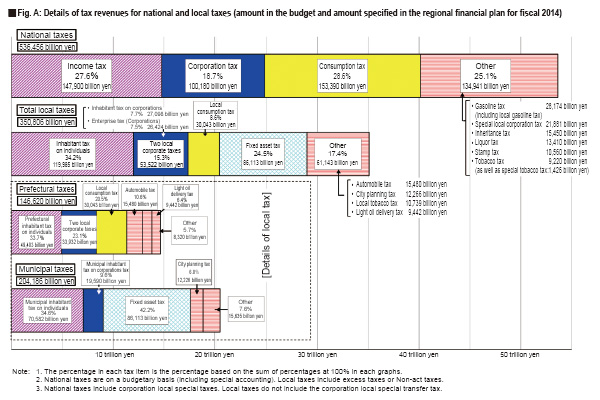

The revenues of a local association (Fiscal 2014 regional financing program amount: 85.6 trillion yen) include local taxes, as well as local allocation taxes, amounts financed by government subsidies, local bonds, and other sources. Local taxes amounted to 35.1 trillion yen, accounting for 41.0% of the total. Under the thinking that the national government cannot remain healthy if the local communities and regions are not healthy, these local taxes that serve as the foundation for the local community must be enhanced and their percentage against revenues further increased, in order to allow local associations to create charming local regions.

Given the great gap between the ratio of the state to regions in tax revenues shouldered by the citizens, and the ratio of the state to regions in expenditures (final spending), the Local Tax Bureau reviews the distribution of tax sources based on how the state and regions should divide the work among them, thereby working to enhance local taxes.

Also note that in recent years the transfer of tax sources from the state (income tax) to the regions (inhabitant tax on individuals) that began in the amount of 3 trillion yen in 2007 and the raising of the local consumption tax rate in April 2014 serve as examples of initiatives to enhance local taxes.

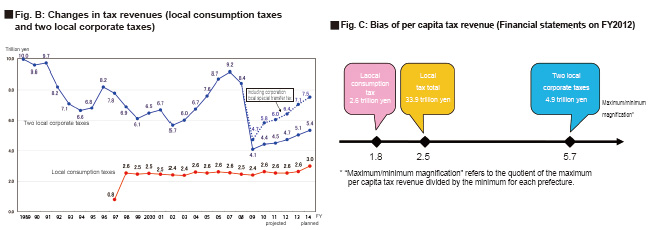

Building a local tax system with low eccentricity and stable tax revenues (Figs. B and C)

The services rendered by local associations are familiar in our lives. As the decreasing birth-rate and ageing population advance and the local public bodies that support social security come to play an increasingly important role, one must avoid creating a great gap among regions in terms of their financial capabilities and consider the significant influence that tax revenue has on changing business.

It is therefore important to establish a local tax system with an evenly distributed and stable tax revenue. A reappraisal is being carried out in 2014 to correct the maldistributions in the imposition of local corporate taxes.

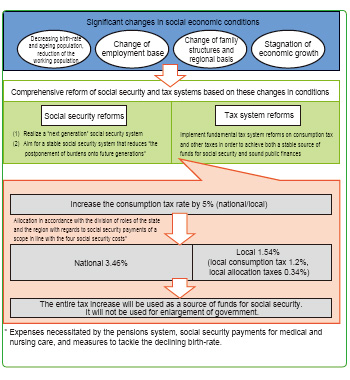

Comprehensive reform of social security and tax systems

Currently, the government is working on comprehensive reform of social security and tax systems that represent a complete overhaul of the taxation system to achieve a reform of social security in order to ensure adequate and stable welfare, to maintain a stable source of funds, and to make public finance sound. This is being done in light of the drastic socioeconomic changes of recent years (such as Japan's decreasing birth rate and ageing population).

With regards to local taxes, the government will increase the local consumption tax rate*. The increased tax revenue will be earmarked for source of funds for social security. The national and local governments have devoted themselves to exhaustively discussing the details for this at meeting venues between the two sides. They were able to reach a conclusion over this based on a shared understanding that the social security system would be made sustainable through combining the two safety nets of the national system and local public non-subsidized services. Moving forward, the LTB will continue enhancing local taxes and building local tax systems with low eccentricity and stable tax revenues in order for local regions to adequately play their role as decentralization reforms are promoted.

* As of April 2014, the tax was raised from 1% to 1.7%. Though previously slated for an additional increase to 2.2% in October 2015, the timing of the increase will be postponed to April 2017.