In order to ensure that local governments provide basic administrative services for residents, such as welfare, education, police, fire and rescue services, and improvement of social infrastructure and to enable them to strengthen childcare policy and other child-related policies as well as promoting DX and GX initiatives with a maximum degree of autonomy and independence, the Local Public Finance Bureau (LPFB) strives to secure and adjust local resources by formulating the Fiscal Plan of Local Governments and strengthen local financial management.

Administrative services closely related to residents’ lives, such as welfare, education, police, fire and rescue services, and improvement of social infrastructure, including roads and river embankments, are implemented in most cases by local governments. Local finance therefore takes an extremely important role, so to speak, as one of the two wheels of a vehicle together with national finance. Consequently, the local finance relating to the ordinary budget for FY2024 totaled 93.6 trillion yen.

For local governments to continue promoting investment in the people and regional economic revitalization, to implement measures to address the aging of society coupled with a low birthrate, including childcare policy, and to take necessary actions in view of wage and price trends, among other matters, it is essential to secure necessary local tax revenue sources.

Local finance is the totality of the finance of about 1,800 local governments, most of which are financially weak municipalities. The shortage of funds for local finance increased swiftly in and after FY1994 due to the decline in local tax revenues, tax cuts, and for other reasons. After that, fund shortages reached a record of 18.2 trillion yen in FY2010 due to the recession. Even in FY2024, with the increase in social security related expenses, there is still a shortage of 1.8 trillion yen.

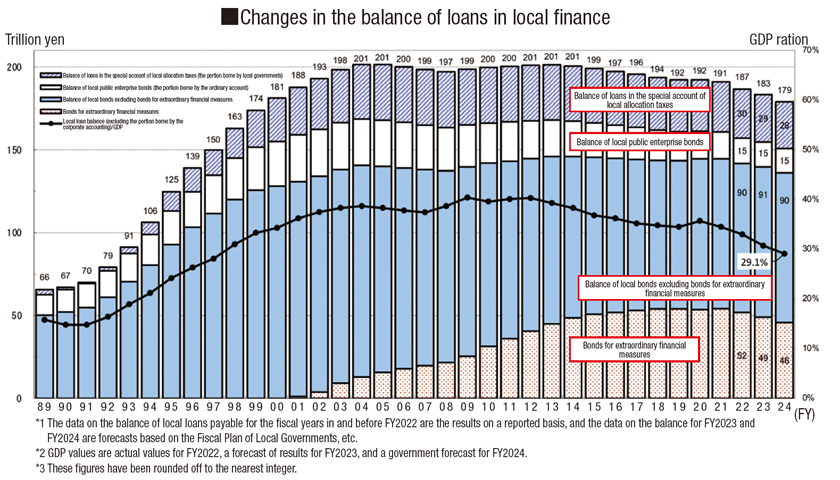

Moreover, with this background of fund shortage, the balance of loans in local finance by the end of FY2024 is expected to be 179 trillion yen, accounting for a considerable 29.1% of GDP.

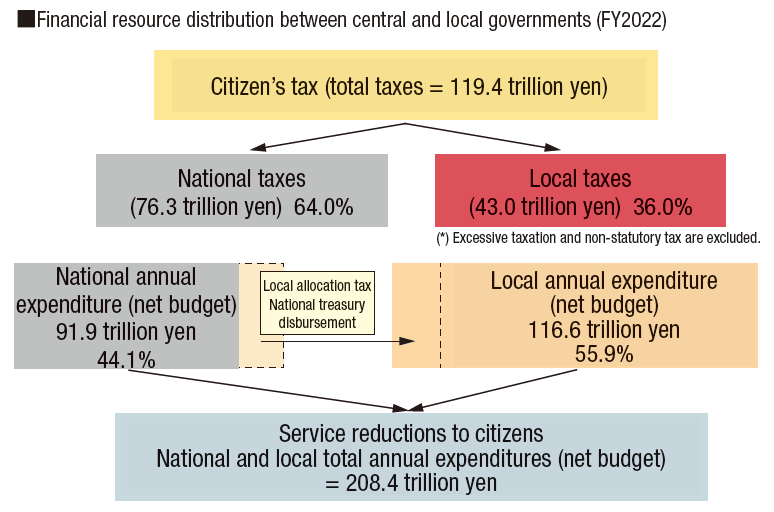

The ratio of central to local government distribution of tax revenue borne by the public is about 3:2.

However, the ratio is reversed (2:3) when taken from the viewpoint of expenditure scale adjusting for the final spending of entities in both the central and local governments.

Accordingly, local allocation taxes and other fund sources whose usage is not limited, as well as government subsidies and funds for projects charged on the national treasury are transferred from the national government to local governments so that local governments can provide important administrative services.

The LPFB secures funds for local governments, such as local allocation taxes and local bonds, through the Fiscal Plan of Local Governments (a set of plans that grasp the revenue and expenditure of local finance) so that local governments can provide important administrative services to the residents regardless of regional gaps due to the degree of population and industrial density or gaps in tax revenues between fiscal years due to business trends.

Funding for local governments should ideally be done from their own funds, such as local taxes collected by themselves. However, in reality, fund sources are regionally unevenly distributed. A mechanism is therefore needed for adjusting this uneven distribution and for ensuring general fund sources (fund sources used for any kind of expenses with their uses unidentified) to local governments with low local tax revenues. Established for that purpose is the local allocation tax.

The local allocation taxes in FY2024 totaled 18.6671 trillion yen.

The annual expenditures of local governments are, as a principle, covered by the annual revenues other than local bonds. However, local governments are eligible to issue local bonds in the case of necessary construction business expenses in terms of fair cost burden or necessary response to an emergency like a natural disaster. Therefore, the LPFB makes the local bond issuance plan as a projection of annual issuance of local bonds in order to secure local bond funds smoothly. In addition, the LPFB manages local bond funds appropriately through the approval of issuance.

Local public enterprises provide essential services for regional development and local residents, such as water works, traffic infrastructure, medical facilities and sewerage treatment. While the business environment is becoming severer due to population decline and the aging of facilities, the LPFB is promoting formulation of business strategies and expansion of service areas or other fundamental reforms to ensure that local public enterprises can stably provide services indispensable for local residents’ lives.

Because of the increase in social security-related expenses due to the aging of population, the financial structure is becoming increasingly rigid, making the local financial situations extremely difficult. In this situation, in order to quickly achieve financial soundness or rebuild, the Act on Assurance of Sound Financial Status of Local Governments establishes new indexes and requires local governments to disclose them thoroughly. In addition, in order to realize more efficient and effective administrative and financial management, efforts to strengthen financial management, such as appropriate management of public facilities and management reforms of local public enterprises, are being promoted.

Promoting regional digitalization

Provincial regions are facing increasingly complex social issues that must be resolved, including revitalizing regional economies, correcting the overconcentration of population in the Tokyo Metropolitan Area, responding to the population decline and the aging of society with a low birthrate, implementing disaster prevention and mitigation measures, maintaining and improving the quality of education, and securing an appropriate level of medical care. In this situation, to realize the Vision for a Digital Garden City Nation, local governments are required to put digital technology into practical use in various fields and use digital expertise to resolve diverse regional social issues.

In order to further promote efforts to resolve regional issues through the practical application of digital technology, the FY2024 Local Fiscal Plan once again set aside funds, worth 250 billion yen, as “expenditure for promoting regional digital society.” In addition, in view of the discussions at the meeting on digital administrative and fiscal reform, which was inaugurated in October 2023, digital administrative and fiscal reform efforts are underway in order to reconsider administrative and financial management from users’ viewpoint and to maintain and strengthen public services and revitalize regional economies by making maximum use of digital technology. Further progress is expected in regional efforts toward digitalization.