Local Taxes are an important financial source for the administrative services of local governments. By enhancing and securing local taxes, which are a sort of community membership fee, the Local Tax Bureau (LTB) proceeds with decentralization reforms and plans and drafts local taxation revisions corresponding to changes in the Japanese socioeconomic community.

Education, welfare, fi re defense, rescue, garbage management, and most of the local services closely related to our daily lives are provided by municipalities and prefectures. Local taxes are a source of funding for such services, borne widely and jointly by the inhabitants of the community and other interested parties, and imposed by prefectures and municipalities according to ordinances. The LTB has jurisdiction over the local tax law that defines this local tax framework.

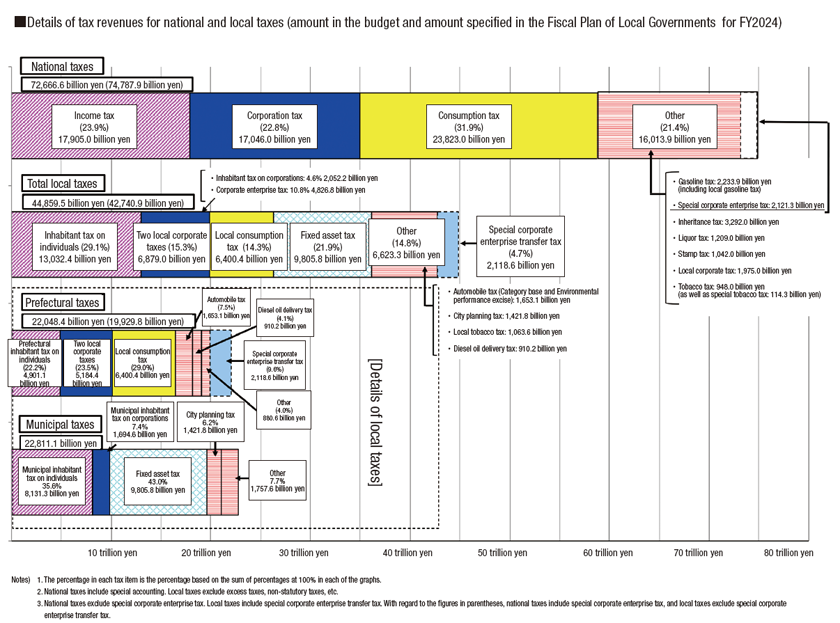

The revenues of local governments (amount of the FY2024 Fiscal Plan of Local Governments: 93.9 trillion yen) include local taxes, as well as local allocation taxes, amounts financed by government subsidies, local bonds, and other sources. Local taxes amounted to 44.9 trillion yen, accounting for 47.8% of the total.

In order to enable local governments to create communities with unique characteristics with their own ideas, it is necessary to promote decentralization and enhance local taxation, which constitutes the foundation of communities. In view of the division of roles between the national and local governments, the LTB has so far made efforts to enhance local taxation. For example, it transferred tax revenue sources worth 3 trillion yen from national taxation (income tax) to local taxation (individual inhabitant tax) in 2007 and raised the local consumption tax rate in FY2014 and FY2019 (in terms of the consumption tax rate: 1.0%→1.7%→2.2%). In addition, from the viewpoint of securing local tax revenue sources necessary for forest development in a stable manner, the LTB introduced the forest environment tax and the forest environment transfer tax in FY2019.

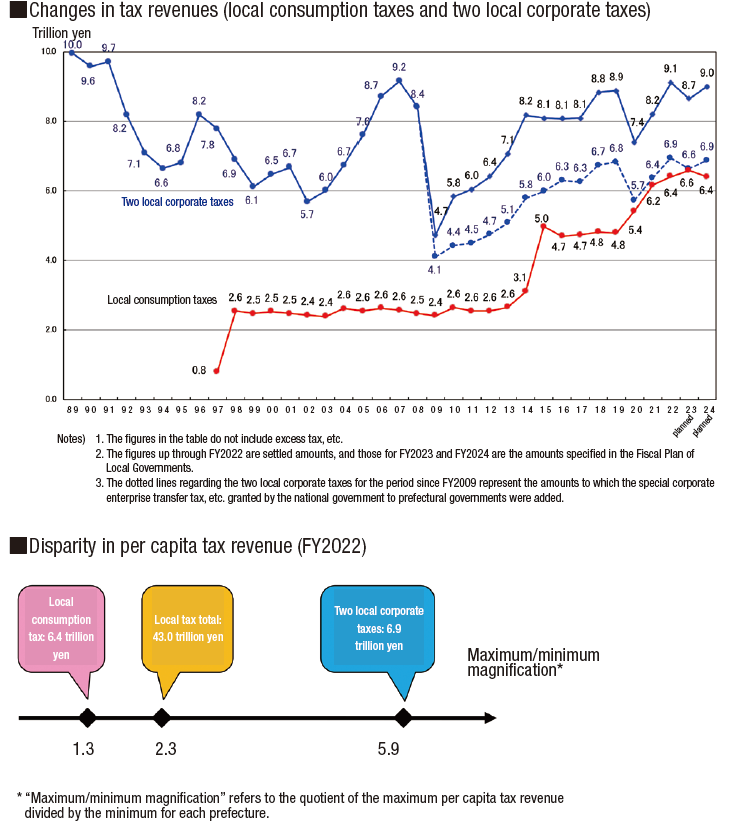

In order to enable local governments to provide administrative services that suit the actual circumstances of their communities, it is necessary to secure the general financial sources necessary for stable financial management. To do so, it is ideal to obtain the necessary financial sources through local taxes, which are collected by local governments themselves. However, it is necessary to keep in mind that when tax revenue sources are unevenly distributed, fiscal capacity gaps may arise between local governments if local taxation is enhanced. Therefore, it is necessary to develop a local tax system with little uneven distribution of tax revenue sources and with stable tax revenues at the same time as making sure to enhance local taxation.

In addition to raising the local consumption tax rate as mentioned above, the LTB has secured tax revenue stability and strengthened benefit taxation by introducing (FY2004) and expanding (FY2015 and FY2016) pro-forma standard taxation under the framework of corporate enterprise tax. In FY2019, in light of the expansion of financial capacity gaps between regions and changes in socioeconomic structures, the LTB introduced the special corporate enterprise tax and special corporate enterprise transfer tax in order to address the structural problem of tax revenues being concentrated in large cities and help cities and rural areas support each other and achieve sustainable development together.

Non-statutory taxes

Local taxes that local governments can levy include corporate enterprise tax, automobile tax, individual inhabitant tax, and fixed asset tax, and these are called statutory taxes. For statutory taxes, taxable items and tax calculation methods are specified by the Local Tax Act. Meanwhile, apart from the taxes specified by the Local Tax Act, local governments may levy their own taxes under local ordinances. Such taxes are called non-statutory taxes and can be divided into non-statutory general taxes and non-statutory taxes for specific purposes, depending on whether their usage is specified by ordinance or not.

When a local government intends to introduce a non-statutory tax, it needs to consult with the Minister for Internal Affairs and Communications and obtain consent therefrom in advance. The Minister for Internal Affairs and Communications must give consent unless the non-statutory tax that the local government intends to introduce falls under any of the following: (i) its tax base is the same as that of national taxes or other local taxes and its burden on residents is extremely heavy; (ii) the tax is likely to seriously hinder the distribution of goods among local governments; or (iii) the tax is not appropriate in light of national economic policies.

By April 2024, more than 50 local governments introduced non-statutory taxes, such as industrial waste tax (Mie, Nagasaki, and Okinawa Prefectures, etc.), nuclear fuel tax (Hokkaido, Fukui, and Ehime Prefectures, etc.), were introduced. "Accommodation tax," which is recently often taken up by media, is also a non-statutory tax (for specific purposes).

Accommodation tax, which was first introduced in Tokyo in FY2002 in order to secure the funds necessary for tourism promotion measures, has since then been introduced by nine local governments, including Osaka Prefecture (FY2016) and Kyoto City (FY2018). In November 2024, accommodation tax is scheduled to be introduced in Niseko Town, Hokkaido. In the future, more and more local governments are expected to consider introducing accommodation tax given the growing tourism demand and needs for administrative services due to increases in overseas tourists visiting Japan amid the recovery from the COVID-19 crisis.

A non-statutory tax for securing a new tax source is to be introduced based on each local government's responsibility and judgment and is considered to be very significant also from the perspective of decentralization of authority.